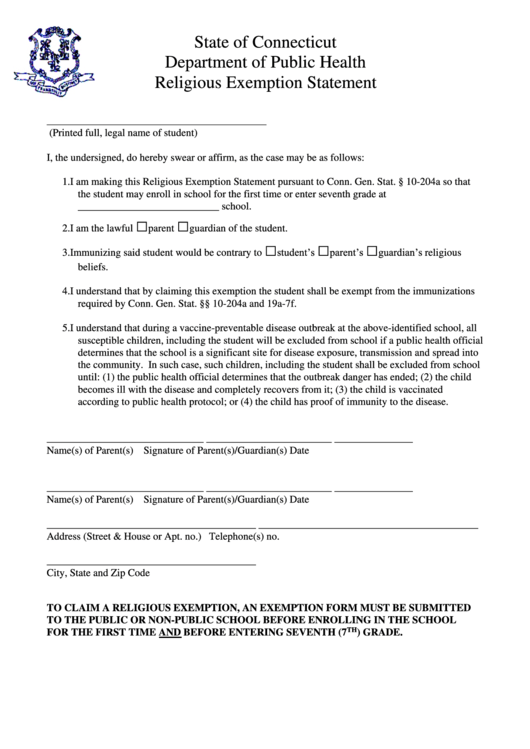

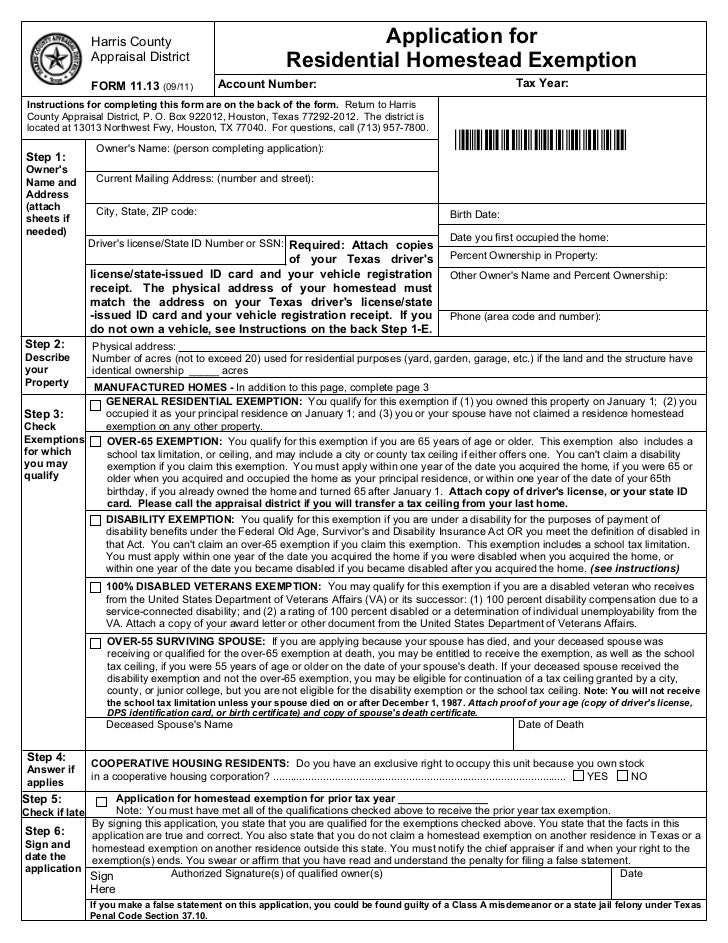

Bupa Tax Exemption Form : California Wage Garnishment - 20 Free Templates in PDF ... : Institutions seeking exemption from sales and use tax must complete this application.

Bupa Tax Exemption Form : California Wage Garnishment - 20 Free Templates in PDF ... : Institutions seeking exemption from sales and use tax must complete this application.. If you and your employer qualify for these exemptions, you. As of january 31, the irs requires that form 1023 applications for recognition of exemption be submitted electronically online at www.pay.gov. (for use by a virginia dealer who purchases tangible personal property for resale, or for. The global tax director, the chief financial officer we are compliant with action 13 of the beps project which significantly increased transparency standards in the form of new requirements for. Property tax exemption request (10/20).

(for use by a virginia dealer who purchases tangible personal property for resale, or for. Find federal forms and applications, by agency name on usa.gov. Property tax exemption request (10/20). Once you've entered all of this information, you'll be required to sign and accept the terms and conditions. For instructions on how to upload your tax exemption form check out this article for a step by step process.

Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites.

As of january 31, the irs requires that form 1023 applications for recognition of exemption be submitted electronically online at www.pay.gov. Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does. These items are exempt from vat so are not taxable. Once you've entered all of this information, you'll be required to sign and accept the terms and conditions. Find federal forms and applications, by agency name on usa.gov. (for use by a virginia dealer who purchases tangible personal property for resale, or for. Commonwealth of virginia sales and use tax certificate of exemption. Fairfax county department of tax administration 12000 government center parkway, suite 223 fairfax, va 22035. Exemption numbers or exemption form* (if applicable). Forming a nonprofit & applying for tax exemption with erin bradrick erin bradrick is senior counsel at neo law group and a contributor to the. The forms listed below are pdf files. Submit your completed tax exemption form to: They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader.

For instructions on how to upload your tax exemption form check out this article for a step by step process. Completed forms should be mailed to: Zurich insurance for cars zurich insurance v hayward zenith insurance company toronto ontario zurich insurance public limited company zenith insurance company jobs zenith insurance company bloomberg zurich insurance dubai careers zenith bank. Forming a nonprofit & applying for tax exemption with erin bradrick erin bradrick is senior counsel at neo law group and a contributor to the. Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites.

They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader.

This includes any cash payment, trade of any personal property, trade of another vehicle or assuming the donor's lien on the vehicle. Tax exemption refers to a monetary exemption which decreases the taxable income. Tax exemptions come in many forms, but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax. All california nonprofit organizations seeking exemption from california corporation franchise or income tax must file either form ftb 3500 or form ftb 3500a with the. Driving, traveling, home offices and student. Discover more about what it means to be tax exempt here. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Employees providing domestic services, such as respite or nursing, may be exempt from paying certain federal and state taxes based in some cases, the employer may also be exempt based on the employee's status. Once you've entered all of this information, you'll be required to sign and accept the terms and conditions. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Property tax exemption request (10/20). Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does. The government may wish to promote one form of business/income today and may want to promote another.

All california nonprofit organizations seeking exemption from california corporation franchise or income tax must file either form ftb 3500 or form ftb 3500a with the. For instructions on how to upload your tax exemption form check out this article for a step by step process. To be exempt, an organization must meet the requirements for exemption as set by the code of virginia and the code of county of fairfax. The government may wish to promote one form of business/income today and may want to promote another. Bupa insurance premium tax exemption form.

As of january 31, the irs requires that form 1023 applications for recognition of exemption be submitted electronically online at www.pay.gov.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Fairfax county department of tax administration 12000 government center parkway, suite 223 fairfax, va 22035. Tax exemption helps in curtailing the burden of taxable income during a financial year. This includes any cash payment, trade of any personal property, trade of another vehicle or assuming the donor's lien on the vehicle. Property tax exemption request (10/20). Employees providing domestic services, such as respite or nursing, may be exempt from paying certain federal and state taxes based in some cases, the employer may also be exempt based on the employee's status. The government may wish to promote one form of business/income today and may want to promote another. Your business is partly exempt if your business has incurred vat on purchases that relate to exempt supplies. Zurich insurance for cars zurich insurance v hayward zenith insurance company toronto ontario zurich insurance public limited company zenith insurance company jobs zenith insurance company bloomberg zurich insurance dubai careers zenith bank. If you have any questions regarding tax forms, or are unsure if your group needs one to host a fundraiser, you can check out this post! This is known as exempt input tax. Submit your completed tax exemption form to: This tax break focuses on items you can deduct on your tax form on an ongoing basis, over the course of the year.

Komentar

Posting Komentar